NIFTY

OPEN INTEREST AND VOLUME

TECHNICAL ANALYSIS NIFTY

OPEN INTEREST AND VOLUME

TECHNICAL ANALYSIS NIFTY

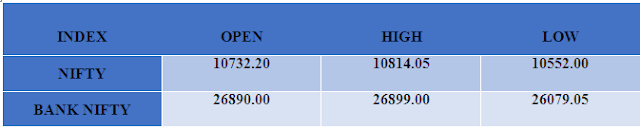

Nifty closed the week on positive

note gaining around 0.80%. As we have mentioned last week, that support for the

index lies in the zone of 10500 to 10550 where Fibonacci levels and medium term

moving averages are lying. If the index manages to close below these levels

then the index can drift to the levels of 10300 to 10400 where long term moving

averages and Fibonacci levels are lying. Last week, it ended 0.67 percent

higher up with a Dragonfly Doji candle. This candle pattern on the weekly chart

implies accumulation on dips. Also, double bottom formation around 10,550

levels is clearly visible. The broader chart pattern suggests the benchmark

index is likely to challenge its upside resistance placed around 10,780 and

10,820 levels. Immediate critical support is placed around 10,700 levels.

30-day exponential moving average (EMA) on the daily chart is placed around

10,630, which may act as the second critical support. Broader chart patterns

suggest the benchmark index is likely to challenge higher resistances placed

around 10,780 and 10,840.

No comments:

Post a Comment