NIFTY

TECHNICAL ANALYSIS NIFTY

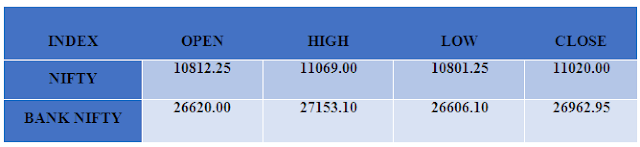

Equity benchmarks formed a higher peak and trough as the Sensex ended at an all -time high at 36548 while the Nifty reclaimed the 11000 mark and ended above the Budget session high at 11023, up 75 points or 0.7%. Profit booking continued in broader markets as the Nifty midcap and small cap dropped 0 .45 % and 0. 2%, respectively. On the sectoral front, financials outshone while realty stocks underperformed.

The

price action formed a small bull candle with long upper shadow while carrying a

positive gap below it, indicating profit booking from higher levels. As

discussed in earlier editions, the overall bias remains positive as the market

continued to form a higher peak -trough on all time frames (daily, weekly &

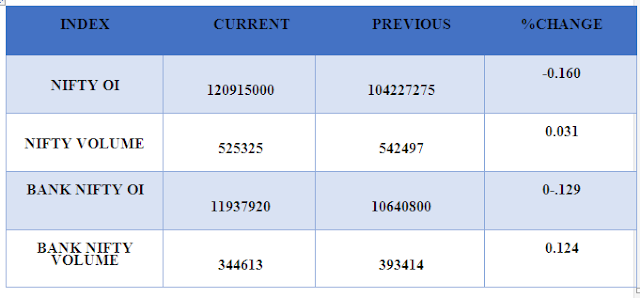

monthly), validating inherent strength of the market . Over the past 10

sessions, the Nifty has rallied 520 points, pulling the stochastic oscillator

in the overbought territory (at 89). Thus, a breather at higher levels cannot

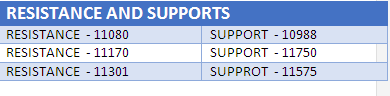

be ruled out. However, we believe any near term breather towards 10930 should

be utilized as an incremental buying opportunity, as it is the lower end of gap

area 11000 -10948 (recorded on July 12), which would set the stage for the

Nifty to challenge an all -time high of 11172 in coming months .

Structurally,

the Nifty maintained the rhythm of maturing each directional move of broader consolidation

(10000 -11171) in seven to eight weeks. Even in the current scenario, the Nifty

saw a strong up move on the corroboration of time wise maturity of corrective

move of eight weeks (started from May high of 10930 ) . The current rally off

two week’s low (10558 to11078 =520 points) is bigger in magnitude than early

-June pullback of 475 points (10418 –10893). Time wise, earlier pullback of 475

points took 15 sessions while the current rally of 520 points has been seen in

just 10 sessions. A rally getting bigger relatively faster signals a structural

turnaround that augurs well for the next leg of the up move towards 11172.

This

structural improvement makes us confident of upgrading support zone to 10700 as

it is confluence of -

• 61. 8 % retracement of 10558 –10957,

placed at 10710.

No comments:

Post a Comment